Over the past year, TRC has dedicated more than 15,000 hours to developing a proprietary software focused on the Employee Retention Credit (ERC). Our journey has involved delving deep into IRS Notice 2021-20, scouring various IRS guidance, and immersing our team in the complexities of the ERC.

During this time, I’ve interacted with approximately 500-600 CPAs and tax professionals, gaining valuable insights into their understanding of the ERC. It's noteworthy that only a handful, about 4 or 5 out of 600, exhibited an expert-level grasp of the partial shutdown test as detailed in Notice 2020-21.

A common trend I’ve observed is a lack of comprehensive understanding of the partial shutdown aspect. This often manifests as a reluctance to engage with the test, or even a dismissive attitude towards its importance. This stance is not limited to external CPAs; it's prevalent among my own colleagues, local professionals in my hometown, and a broader spectrum of tax professionals on various platforms.

The root of this issue seems to lie in the significant investment of time required to fully grasp Notice 2021-20. I estimate a minimum of 80 hours of dedicated study, along with practical application through at least 5 real-world ERC analyses, is necessary to achieve expertise. Additionally, becoming proficient in researching government orders, a task that can be arduous given the obscurity of some records, requires another 30 hours of effort. Without the aid of Artificial Intelligence in streamlining this process, it would have been a daunting task.

However, it's crucial to note that mastering these skills might seem impractical to many, as the ERC is set to sunset in April of 2024. And fully in April, 2025. This finite timeline may be why many tax professionals opt to overlook the ERC, some even developing an aversion to it.

I recall a particular instance with a CPA who expressed frustration at having to consider the ERC for a client after our interaction. Despite our team's diligent efforts in that case, the lack of appreciation was disheartening.

The issue of 'Mill practices' in the industry also warrants attention. Similar to many tax professionals, these mills often bypass the partial shutdown test and qualify their clients regardless. To mitigate this, two key actions were necessary: TaxPros needed to prioritize expertise in Notice 2021-20 and related guidance, and the IRS needed to implement stringent measures against such mills early on.

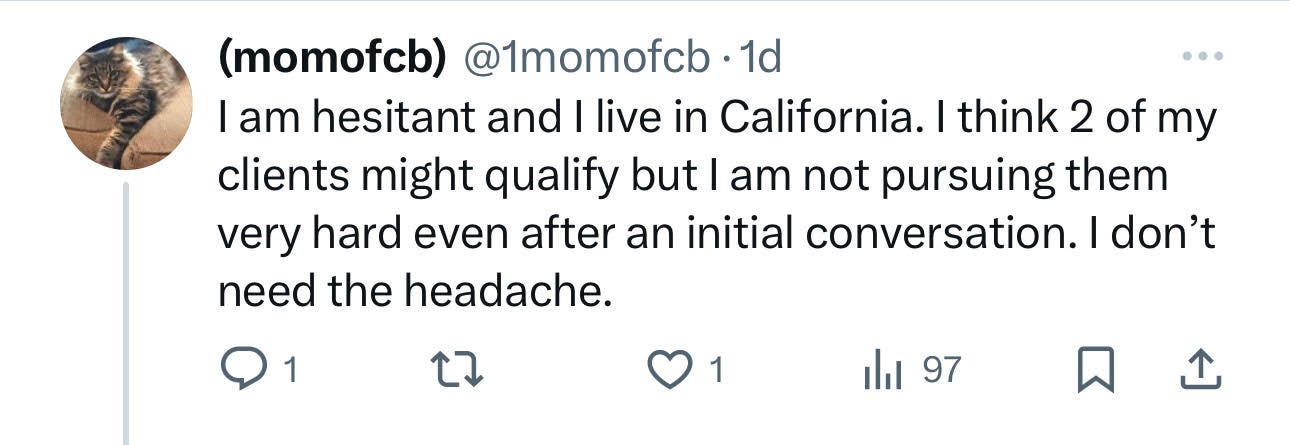

In the current landscape, I find myself browsing industry forums mostly for amusement. However, I remain committed to providing initial reviews for businesses whose CPAs have not fully addressed their needs. For instance, just yesterday, a tax pro mentioned having potential ERC-eligible clients in California but was deterred by the complexity involved.

In conclusion, understanding the Partial Shutdown test is not just a tax professional's duty; it's a crucial aspect of the ERC that holds equal weight with the Gross Receipts decline criteria. Tax professionals owe it to their clients and themselves to fully comprehend this test, ensuring informed and accurate advisement.

This is more than just one man's opinion; it's a call for diligence and expertise in navigating the intricate landscape of the ERC.